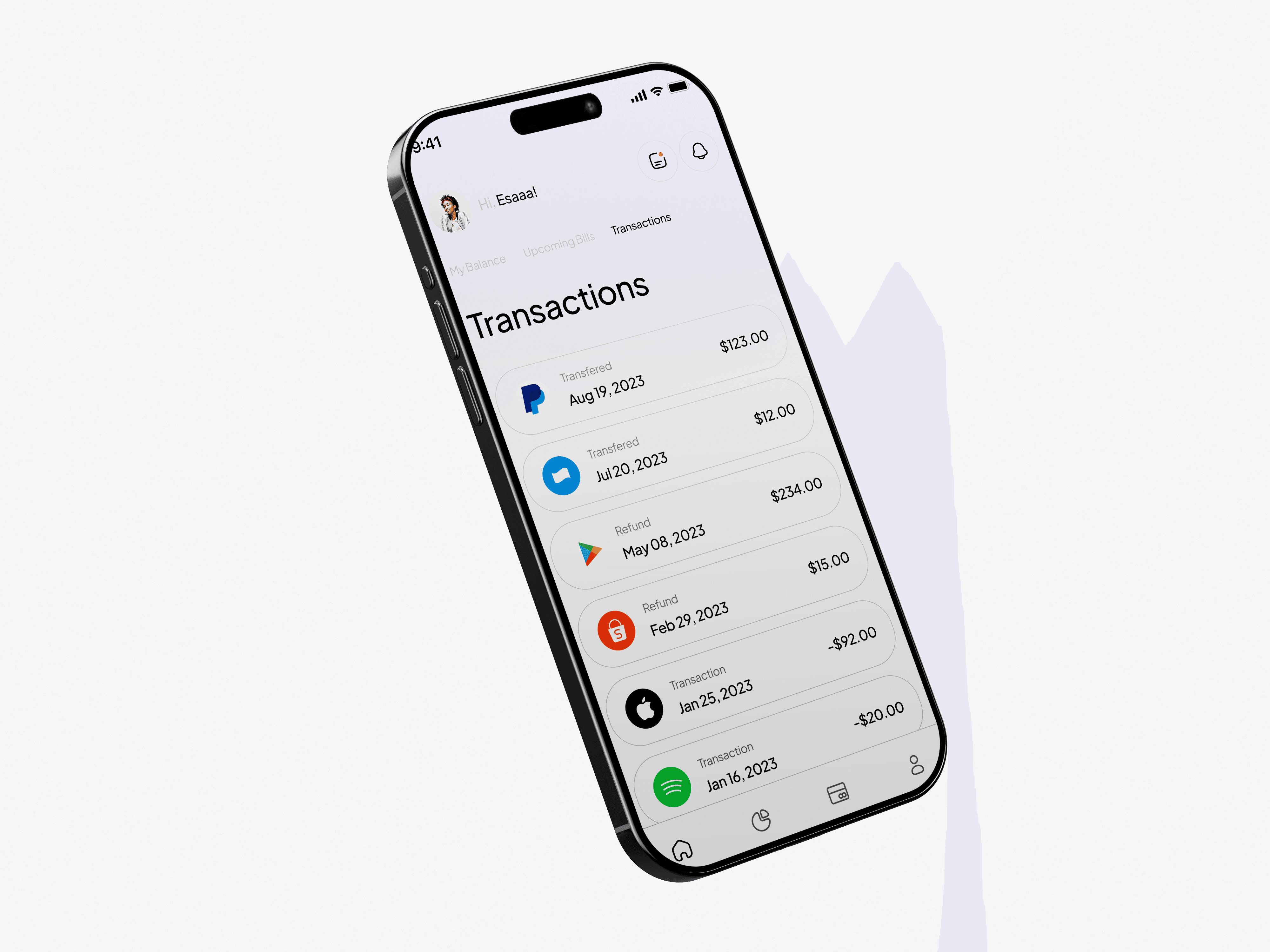

Aegis Money

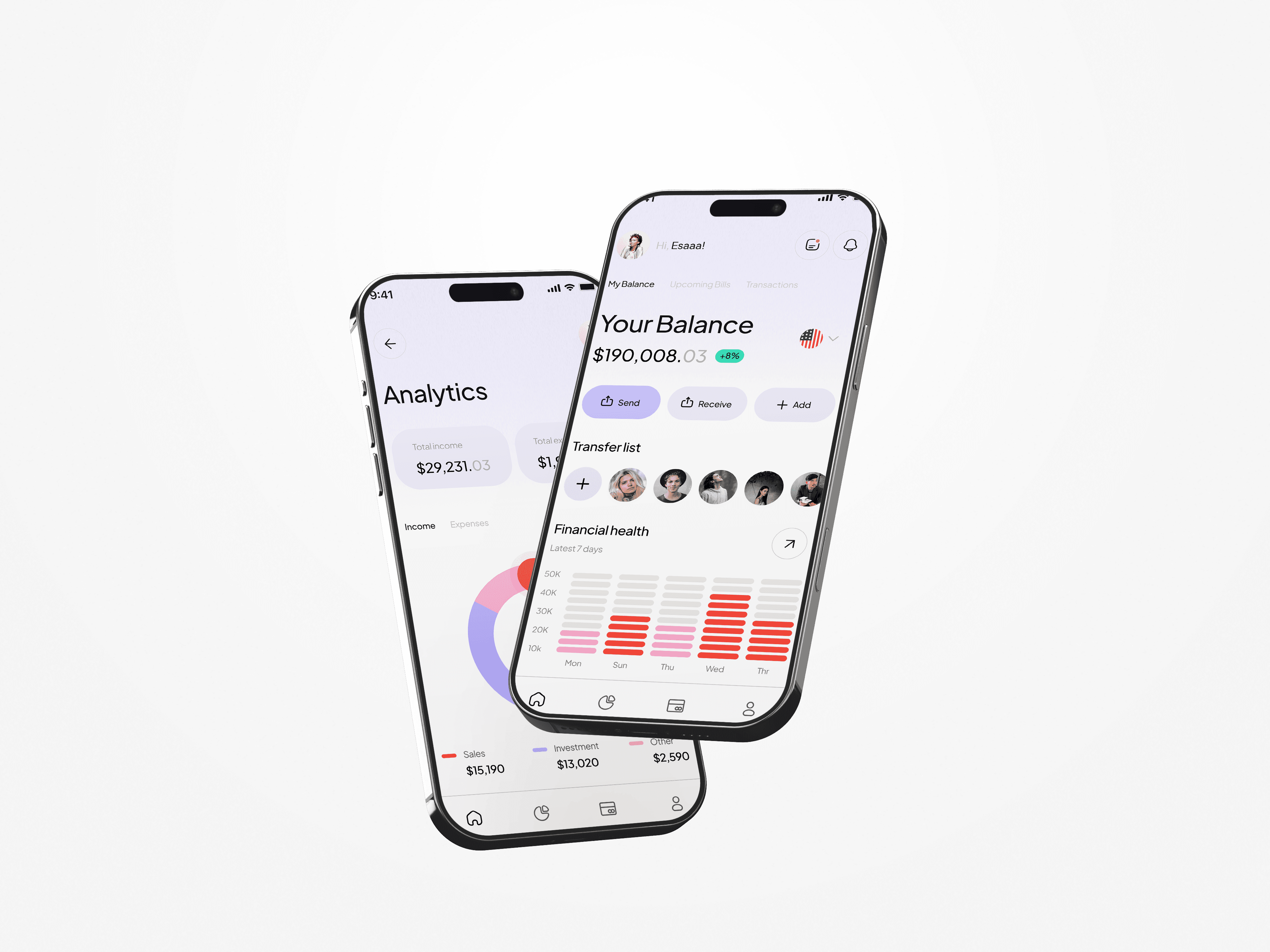

A unified financial command center merging multi-bank aggregation, smart subscription management, and expense analytics into a single, intuitive ecosystem.

CLIENT

Aegis Money

SERVICE PROVIDED

Product design, Ui/UX , Mobile App Development

TIMELINE

10 Weeks

Solving the "Subscription Fatigue.

In the modern digital economy, a user's financial life is fragmented across multiple banking apps and hidden recurring payments. Users often lose track of monthly subscriptions (SaaS, Streaming, Utilities), leading to "vampire costs" that drain their monthly budget unnoticed.

Unified Financial Clarity We designed Fintech to act as a central nervous system for personal wealth. The challenge was to architect a dashboard that could aggregate diverse banking streams and visualize "Financial Health" instantly. We moved beyond simple transaction lists to create a proactive budgeting engine that alerts users before they overspend.

Automated Fiscal Intelligence.

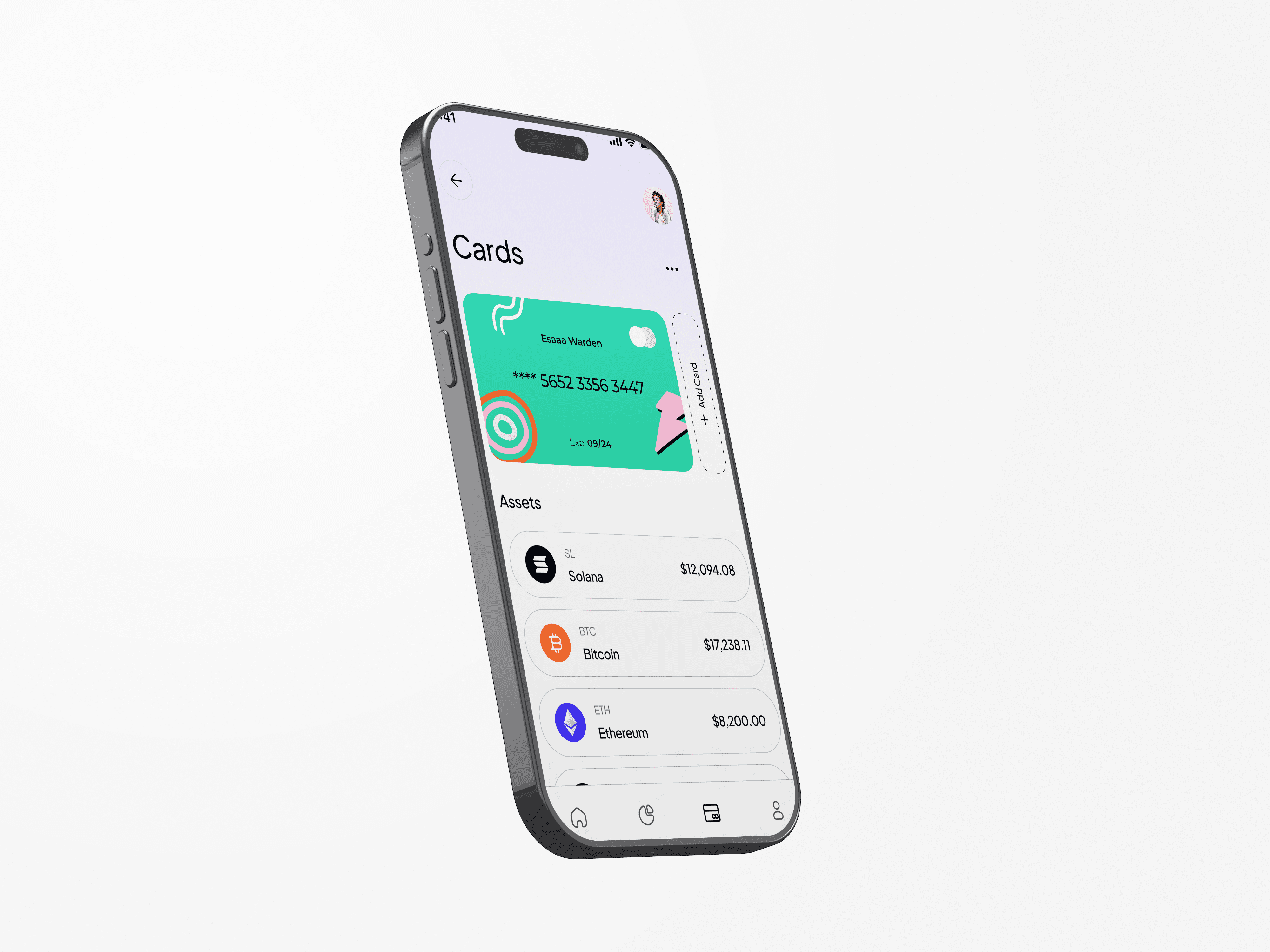

We engineered the platform to be proactive, not reactive. The interface uses a "Card-First" design language, allowing users to visualize different spending accounts and investment pots seamlessly.

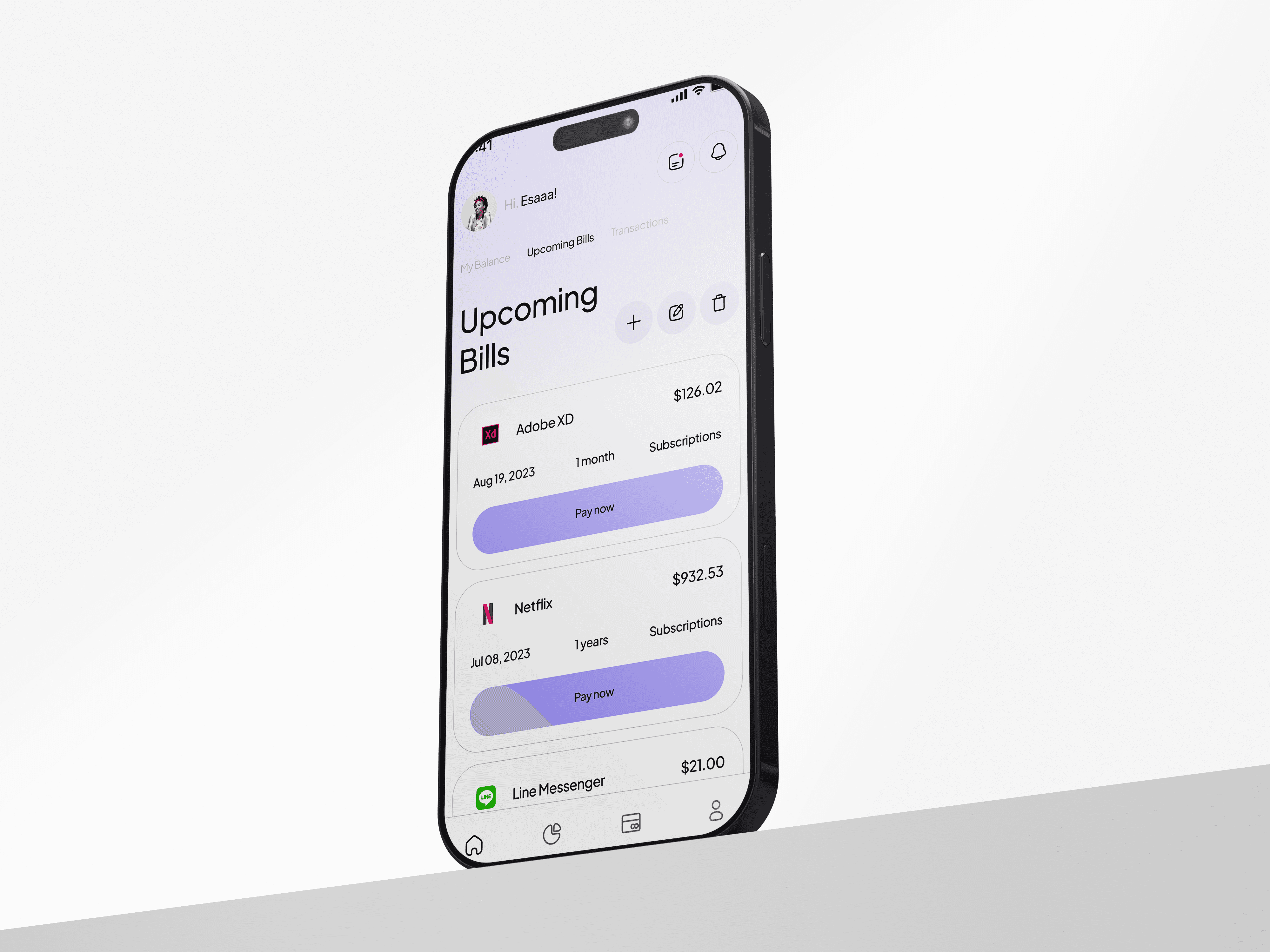

Smart Subscription Tracking: We built a predictive engine that identifies recurring billing cycles (e.g., Adobe XD, Netflix) from transaction history, allowing users to cancel or manage upcoming bills directly from the dashboard.

Unified Asset View: The "Assets" module aggregates total net worth, pulling real-time data from connected savings accounts and investment portfolios.

Frictionless Peer-to-Peer: The transfer system is optimized for speed, visualizing recent contacts (The "Transfer list") to reduce cognitive load during daily splitting of bills.

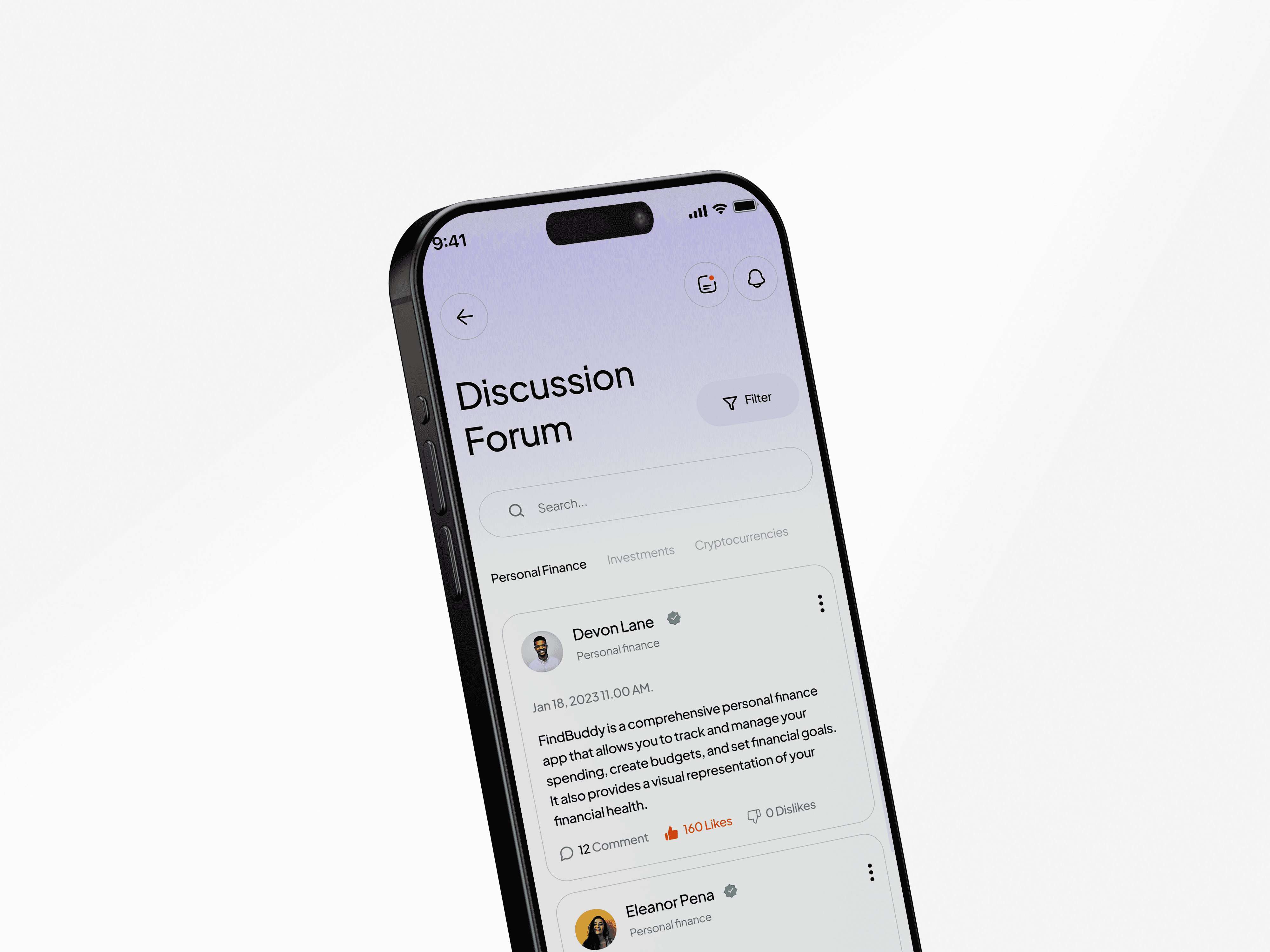

Financial Literacy as a Feature.

True wealth management requires community and education. Unlike standard banking apps, we integrated a Discussion Forum directly into the core navigation. This transforms the app from a passive tool into an active learning hub where users share budgeting tips and financial advice.

35% Increase in daily engagement due to the "Community Forum" feature.

Zero Missed Payments: The "Upcoming Bills" alert system reduced late fees for beta users by 90%.

Total Transparency: Users reported a significantly higher understanding of their monthly cash flow within the first week of use.

"Tectonix didn't just build a banking app; they built a financial companion. The ability to see my upcoming Netflix bill and my savings growth in one view has completely changed how I manage my salary."

— Product Lead, Fintech Inc.